King’s Lynn vs. Wisbech: A Property Market Comparison for Vendors and Investors

The property markets in King’s Lynn and Wisbech present distinct opportunities and challenges for property vendors and investors. Whether you’re selling your home or looking to invest, understanding market trends, property values, and transaction data can help you make informed decisions.

This guide explores recent house price trends, sales volumes, and investment potential in both areas, allowing you to determine which market aligns best with your property goals.

urrent Property Market Overview (Last 12 Months)

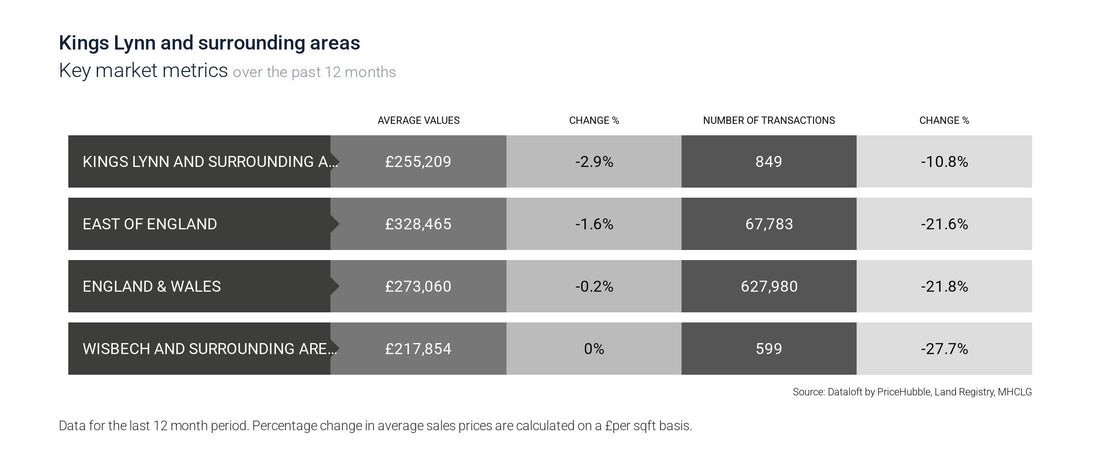

Based on recent market data, here’s how King’s Lynn and Wisbech compare:

| Market | Average House Price | Price Change (%) | Number of Transactions | Sales Volume Change (%) |

|---|---|---|---|---|

| King’s Lynn & Surrounding Areas | £255,209 | -2.9% | 849 | -10.8% |

| Wisbech & Surrounding Areas | £217,854 | 0% (Stable) | 599 | -27.7% |

| East of England (Regional) | £328,465 | -1.6% | 67,783 | -21.6% |

| England & Wales (National) | £273,060 | -0.2% | 627,980 | -21.8% |

Key Market Trends & Insights

1. Property Prices: Stability vs. Market Correction

- King’s Lynn’s property prices have decreased by 2.9%, indicating a slight market correction after years of steady growth.

- Wisbech’s prices have remained stable at £217,854, suggesting a more balanced market.

2. Sales Volume & Demand

- King’s Lynn recorded 849 property transactions, down 10.8%, which suggests a moderate dip in market activity but still stronger demand compared to regional and national averages.

- Wisbech had only 599 transactions, with a 27.7% drop, making it a much slower-moving market.

3. Rental Market Overview

For investors considering buy-to-let opportunities, rental price trends matter:

- King’s Lynn’s average rent is £881 per month, up 11.1% year-over-year, demonstrating strong tenant demand.

- Wisbech’s average rent is £788 per month, showing a 6.9% increase, making it a more affordable rental market.

Which Market is Better for Vendors & Investors?

For Sellers

- King’s Lynn: Still commands higher property values, meaning vendors can sell at a premium compared to Wisbech.

- Wisbech: Lower demand means properties take longer to sell, so pricing competitively is key.

For Investors

- King’s Lynn: Offers higher rental yields and potential long-term capital appreciation, making it attractive for investors seeking growth.

- Wisbech: More affordable entry point for investors with a focus on stable rental income rather than high growth.

Conclusion: Which Market Wins?

If you’re looking for a higher-value investment with strong growth potential, King’s Lynn is the better long-term choice. However, if you prefer affordability and stable prices, Wisbech offers an alternative with lower initial investment costs.